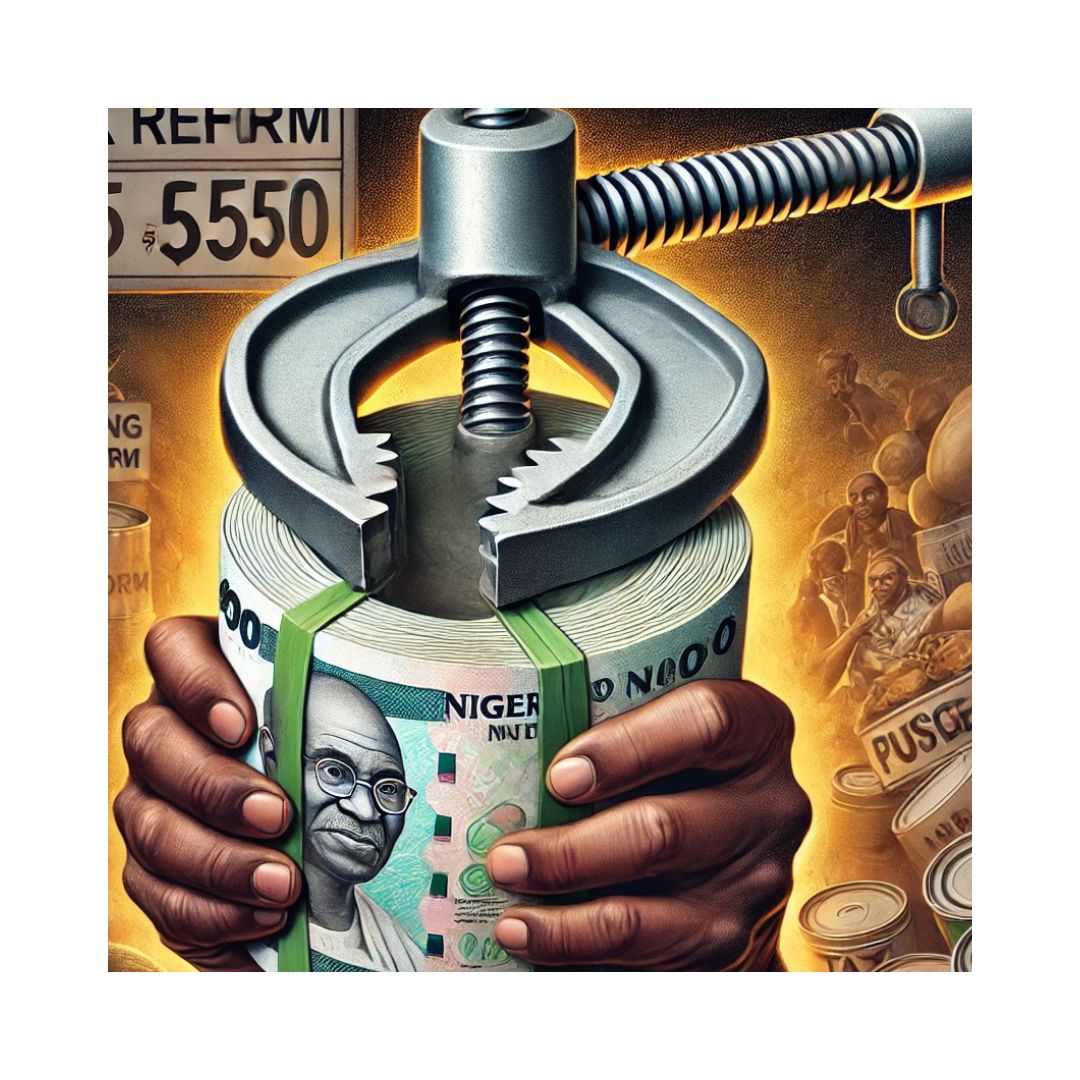

President Bola Tinubu’s proposed Tax Reform Bill has sparked intense debate in Nigeria, drawing both support and sharp criticism. With inflation at record levels, high fuel prices, and widespread unemployment, the introduction of a new tax framework is seen by many as another burden on an already struggling population.

The bill promises to overhaul the nation’s tax system to improve government revenue and economic stability, but its potential consequences have led to a series of contentious discussions among politicians, experts, and ordinary Nigerians alike.

The federal government insists that the Tax Reform Bill is critical for Nigeria’s long-term economic survival. According to government representatives, the country’s tax revenue is far below global standards, with the informal sector largely untapped. This tax reform, they argue, will help Nigeria achieve fiscal stability, reduce dependency on oil revenues, and ensure better funding for critical sectors like education, healthcare, and infrastructure.

The government points out that increasing tax collection will allow for a reduction in the budget deficit and a reallocation of resources to critical national projects.

The government also highlights the necessity of tax reforms to make the country more competitive in the global economy. By creating a more efficient and equitable tax system, the aim is to encourage investments that could drive growth and job creation. However, the timing of the reform has drawn widespread ske

Tax burden on a struggling population

However, critics argue that the timing is wrong, and the implementation could have disastrous effects on the average Nigerian. Tax experts, development economists, and opposition politicians are on one side. They argue that the tax burden will be disproportionately placed on Nigerians who are already struggling with inflation, high fuel prices, and limited job opportunities.

Tax analysts, for instance, have raised concerns about the regressive nature of the Tax Reform Bill. “This bill is not designed with the average Nigerian in mind,” says Dr. Akinwale Abiola, a financial analyst. “It will likely worsen income inequality. It targets consumption-based taxes and higher income taxes without any clear plan for alleviating the burden on the poor.”

Experts say the bill proposes to increase taxes on goods and services, including essentials like food and transportation. It also aims to expand the scope of Value Added Tax (VAT). The tax on small businesses, particularly those in the informal sector, will also rise. Given that many Nigerians depend on small-scale businesses for survival, these tax hikes could push them further into poverty.

“Many Nigerians are struggling to make ends meet, and now the government wants to raise taxes on goods and services they can hardly afford,” says Dr. Ngozi Eze, an economist and tax consultant. “How do they expect people to pay these taxes when most of them are not gainfully employed?”

Tinubu’s Tax Reform Bill: Resistance the Senate

The resistance within the Senate is palpable, with key figures like Senator Mohammed Ali Ndume opposing the bill’s rushed passage. Ndume expressed concern about the lack of consultation and warned against sidelining proper procedures to push through such a crucial piece of legislation. He has also raised valid questions about the bill’s long-term impact.

Opposition senators argue that the bill does not account for Nigeria’s current socio-economic realities. Senator Ndume insists that the bill should be suspended until there is a clearer understanding of its implications on the Nigerian populace. “Tax reform is important, but it must be inclusive and considerate of the people’s welfare,” he said.

Proposed impact of Tinubu’s Tax Reform Bill on informal sector

Development economists have also voiced concerns about the bill’s effect on Nigeria’s vast informal sector. Approximately 70% of Nigeria’s workforce is engaged in informal activities, from street vendors to artisans. The tax reform proposes stricter taxation on informal businesses. This is a sector that is already struggling with high operational costs, inadequate infrastructure, and a lack of access to finance.

Chijioke Njoku, a small-scale artisan based in Lagos, argues that such reforms will force many small businesses to close. “How do they expect me to pay taxes when my income is not guaranteed? Every day is a struggle just to make enough to feed my family,” he said. Njoku further expressed that this bill could put a stranglehold on millions of Nigerians who rely on their businesses for survival.

“Small businesses are the backbone of Nigeria’s economy,” says Dr. Abayomi Daramola. “Many of these businesses are barely making a profit. Imposing additional taxes on them without offering any incentives for growth is counterproductive.”

Limited opportunities to generate income

Experts on employment and labour economics also highlight that the bill’s timing coincides with a period of economic stagnation. Unemployment rates in Nigeria are highs, with many young Nigerians unable to find work. The World Bank recently reported that over 40% of Nigerian youth are either unemployed or underemployed. This places a severe strain on their ability to contribute to the economy or pay taxes.

Mrs. Mayen Dickson, a labor economist, argues that any tax reform should prioritize job creation and support for small businesses. “The bill does not address the root causes of unemployment, which are the lack of job opportunities and insufficient infrastructure,” she said. “We need policies that create jobs, not ones that further burden those who are struggling.”

Many Nigerians simply do not have the disposable income to meet the increased tax obligations. The average Nigerian worker is already struggling to manage daily expenses. This raises the question affordability.

The question of affordability

A major concern among Nigerians is where they will get the money to fulfil the tax obligations. Many households are already battling inflation, which has drastically reduced their purchasing power. With unemployment at a high and wages stagnant, any additional taxes could be devastating.

“Many Nigerians are living from hand to mouth,” says Hon. Victor Amos. “Asking them to pay higher taxes is unreasonable when they don’t even have enough to survive.”

Dr. Akin Ige, a development economist, agrees: “If the tax reform is implemented as planned, it will push millions of Nigerians deeper into poverty. We need a system that supports people before it demands more from them.”

Leave feedback about this